The CFO's Guide to Credit Order Hold Processing

In the dynamic world of B2B credit management, having a solid credit order hold process is essential for financial stability and success. The CFOs, credit managers, and departments in charge of overseeing credit in industries like manufactured products wholesale, media products distribution, food distribution, construction, and pharmaceuticals face an ever-growing challenge: maintaining the delicate balance between profit generation and risk aversion. At the heart of this challenge lies one of the most impactful processes in a company's credit workflow: credit order hold processing.

This guide illuminates the task of credit order holds, exploring practical strategies, a real-world example, and critical insights on how to streamline this pivotal operation.

Credit Order Holds Demystified

The cornerstone of a robust credit management system, order hold processing, encompasses the complex orchestration of assessing, approving, and releasing customer orders based on their transaction performance history.

Order holds serve the essential function of safeguarding against potential bad debt and ensuring that the cash flow of the business remains positive. When an order is placed under a credit hold, it prompts a review process to ascertain if the customer’s financial situation aligns with the transaction's risk profile. The speed of order approval is also a crucial factor. Instant releases mean the customer can quickly buy supplies and continue operations, minimizing delays and maintaining a consistent cash flow. Customers who need to wait days to buy goods will most likely turn to other suppliers who understand their need for urgent credit reviews.

Effective management of credit order holds not only shields your company from unnecessary credit risks but also fosters a structured approach to enhancing customer relationships. Additionally, an efficient credit hold framework naturally frees up valuable time for credit managers. The process is less about creating barriers and more about strategically managing the intricate dance between business growth and financial stability.

Why Credit Order Holds Matter

Let’s delve deeper.

Risk Mitigation Redefined

Order holds are your frontline defense against potential credit defaults. By analyzing past payment behaviors, assessing the customer's current financial standing, and cross-referencing credit limits, order holds ensure that each transaction is a step towards growth, not a risk.

The Art of Cash Flow Management

Consider credit order holds your silent cash flow management allies. An efficient hold process ensures that your company's accounts receivable are kept in check, reducing the cash conversion cycle and enhancing liquidity.

Fostering Customer Relationships

The most successful enterprises are those that know when to be firm and when to be flexible. Credit hold management, when executed with finesse, can demonstrate to customers that you're a dynamic partner. It's an avenue for a customer-centric business that ensures your clients can rely on you for both service and financial transactions when most critical.

An Effective Credit Order Hold Process

Let's take a look at the key building blocks.

Establishing Credit Policies and Procedures

It's impossible to manage what's not defined. Clear and concise credit policies and procedures provide the groundwork for your order hold structure. They should be holistic, covering everything from credit application considerations to order release protocols.

For example, a credit department may establish that any order that is within 30% of the customer’s credit limit can be released if there is a hold. Another department can instill that any order that is within 30% of the customer’s credit limit and has an average of no more than 90 days past due, can be released.

The Art and Science of Credit Risk Assessments

Risk assessment is where art meets science. A combination of quantitative analysis and qualitative judgment calls can help in gauging the risk associated with customer orders. This combination also leads the way to establishing situational and customer risk criteria. Consistency and thoroughness in this area can make or break your credit management strategy.

Credit Limits as a Defensive Line

Credit limits are not arbitrary numbers—they are strategic tools in your credit management arsenal. Setting the right credit limits involves data analysis, customer relationship history, and future business projections to ensure no order slips under the radar.

Proactive Monitoring and Review

A credit order hold process is not set in stone. It requires agile monitoring and regular reviews. This real-time approach adapts to the dynamic nature of businesses and customer finances, ensuring a proactive stance in credit management.

Best Practices for a Smooth Credit Order Hold Operation

Let's switch gears to the driving practices that propel a credit order hold system from functional to phenomenal.

The Need for Automation

In today's landscape, reaction time is a competitive advantage. A timely response to credit order holds—be it a release or a prolongation—can make all the difference in customer satisfaction and operational agility.

Automation offers numerous benefits, including a substantial reduction in manual processing errors and human oversights, faster order release decisions and a systematic analysis of customer credit data. Moreover, automation systems can process high volumes of order holds in seconds, ensuring a smooth order approval flow without compromising accuracy or credit risk.

Technology Integrations

Stagnation is the enemy of efficiency. Incorporating the latest fintech advances can significantly transform traditional processes, which often suffer from a lack of comprehensive data analysis, heightened risk of human error, and delays in time-sensitive approvals.

With software solutions that seamlessly integrate with your existing ERP or accounting systems, you can ensure that credit decisions are made in real time and based on the most accurate information available, thus maintaining a healthy cash flow and promoting operational efficiency.

Time to Cut Homegrown Systems

Out-of-the-box or homegrown systems are not only rigid and overly simplistic, they rely on basic or mundane criteria for placing order holds, but they also frequently overlook valuable transaction performance data. These traditional systems typically demand a credit manager’s undivided attention for approval evaluation, failing to offer true efficiency. Moreover, maintaining and updating these systems can be a significant financial burden, requiring in-house IT resources and hiring specialized talent.

More Hands on Deck

Cloud-based applications can provide the extra support needed to handle high volumes of order holds effectively. By using a SaaS credit system, like Bectran, your order holds will be evaluated in real-time for continuous reprocessing of release eligibility and reanalyzed based on new account information. Although it may sound like a time-consuming process, order release can be achieved in milliseconds, with an 80% department efficiency increase. This ensures accounts are always up to date and customers receive supplies the moment they start their purchase, which in turn can help them expand their business and take on bigger projects.

When picking a SaaS provider - make sure you're able to tailor your order hold criteria to your company standards. Having a tailored process lowers the risk of accidental order holds or approvals, and typically contains a transparent audit section to review past approvals, rejections, and pending orders. Good, customer-centric SaaS providers offer self-service models that enable credit management teams to remain lean, enhance agility, and cut IT resources. They add to the credit teams' capabilities with their plug-and-play features, while removing the need for IT involvement.

A Real-World Use Case

Order holds are set in place to help companies manage exposure for their customers and ensure that customers do not overextend their credit limits without any checks. However, order holds can also cause unnecessary blocks on orders due to:

- Insufficient enterprise resource planning (ERP) logic that leads to blocked orders

- Lack of advanced data analysis that can capture important trends and metrics for a customer

- Increased time to release orders due to slow processing of order blocks

- Inability of systems or existing solutions to scale to meet growing business needs

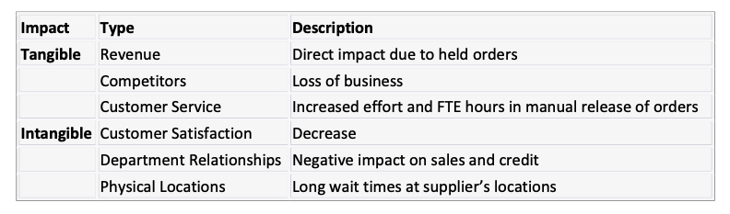

These issues in order releases can have a lot of tangible and intangible impact on businesses, specifically:

Here is a case of how a leading distributor of building supplies solved these growth obstacles with automation, AI and ML.

Key Challenges:

- Handling large order volumes that scale with the business need

- Instant releases that can be fed to the ERP in a near real-time fashion

- Lack of additional re-processing mechanisms to evaluate orders in a periodic fashion if customer account attributes change

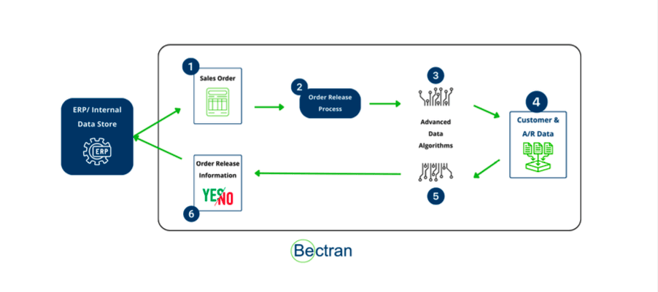

Process with Automation Incorporated:

- Order is created in the ERP and sent to Bectran via. real-time APIs

- Bectran uses advanced algorithms to calculate eligibility for release using customer data across the hierarchy

- Ensures data is available for processing

- Captures and updates account level changes like exposure, days past due, aging

- The same order is then passed through multiple models that are created by the credit department for order release

- Executing a release decision and transmitting data back to ERP

- Reprocessing order on hold to recompute eligibility for release

All these checks happen in a matter of seconds, to ensure that the customer does not have to wait before they can purchase a product from the supplier.

Results and Benefits:

Implementing automation, AI/ML provides a significantly better front-end customer experience while bringing efficiency gains to the entire credit department.

Our client experienced several results:

- Avg Order release went from 5 minutes --> 3 seconds

- Calls to credit department from 90/day --> 30/day

- Order released per day from 200 --> 750

- Not to mention the decrease and churn of lost business, increase in customer experience and time allocation to focus on larger strategic orders.

Bring Efficiency to Your Order Holds

Efficient credit order holds are at the core of a successful credit management strategy. By combining automation, technology integrations, and cutting out-of-the-box solutions, businesses can foster customer relationships while mitigating the risk of financial losses.

Next steps

Ready to bring efficiency into your department? Schedule a demo today

Get started today