A Real-World Use Case of Implementing AI/ML to Order Holds

As businesses navigate complex financial landscapes, one of the primary challenges that AR and credit management teams face is the sheer volume of data they have to process. The vast amounts of manual processes that traditionally took up significant time and resources are now being targeted for automation, and AI offers a promising path forward. With AI's ability to process data at unprecedented speed and accuracy, tasks such as cash application, credit, collections and dispute management can be performed more efficiently, freeing up time and resources for more critical tasks.

There are many options for utilizing AI in credit and AR processes already, but one tangible example we’ve seen firsthand is the implementation of a custom model to automate the processing, reviewing and approving of order holds at enterprise levels of high-value, high-transaction environments.

Current Issues

- Inefficient manual reviews: Often, held orders are manually reviewed to determine if they should be released, leading to delays and potential human error.

- Arbitrary thresholds: Traditional systems might place holds based on simplistic criteria (like order value) without considering the broader context or the client's account history.

- Customer dissatisfaction: Frequent and unnecessary holds can frustrate customers, potentially harming business relationships and trust.

Resolution with AI/ML

- Automated decision-making: AI can assess a variety of factors (e.g., order size, client history, current AR balance) in real-time to determine whether an order should be released, improving efficiency.

- Dynamic thresholds: Instead of rigid criteria, AI can establish dynamic risk profiles based on comprehensive data, resulting in smarter, context-aware holds.

- Proactive notifications: AI can notify relevant parties (both internal teams and customers) in advance if there's a potential for an order hold, allowing for preemptive resolution.

Use Case: How a Large Distributor Reduced Order Holds by Over 60%

This case study analyzes an industry-leading, enterprise distributor of building supplies and its approach to solving a recurring growth obstacle with automation, AI and ML. The solution, which leveraged unique, yet replicable logic, allowed the business to decrease average order holds by more than 60% and increase productivity exponentially.

The Business Problem and its Automated Solution

Order holds are a critical business process for most companies with high transaction volumes. They help companies manage exposure for their customers to ensure that customers do not overextend their credit limits without any checks. However, order holds can also cause unnecessary blocks on orders due to:

- Insufficient enterprise resource planning (ERP) logic that leads to blocked orders

- Lack of advanced data analysis that can capture important trends and metrics for a customer

- Increased time to release orders due to slow processing of order blocks

- Inability of systems or existing solutions to scale to meet growing business needs

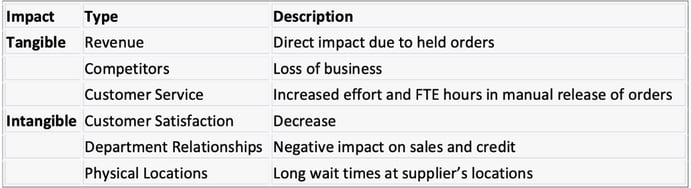

These issues in order releases can have a lot of tangible and intangible impact on businesses, specifically:

Key Challenges

An analysis of the above issues has revealed the following key gaps in the order hold processing for this company:

- Handling large order volumes that scale with the business need

- Instant releases that can be fed to the ERP in a near real-time fashion

- Lack of additional re-processing mechanisms to evaluate orders in a periodic fashion if customer account attributes change

Process Flow

- Order is created in ERP and sent to Bectran via real-time APIs

- Bectran uses advanced algorithms to calculate eligibility for release using customer data across hierarchy

- The same order is then passed through multiple models that are created by the credit department for order release

.png?width=750&height=314&name=Sales%20collateral%20graphs%20(26).png)

All these checks happen in a matter of seconds, to ensure that the customer does not have to wait before they can purchase products from the supplier.

Real-Time Data Processing Using Advanced Algorithms

In order to address the business challenges and scale requirements for order release

- Ensure data is available for processing at the time of order creation

- Capturing and updating customer account level changes like exposure, days past due, aging balances for accurate order release, etc.

- This is also required to calculate these items across a customer account hierarchy relationship that may exist, especially in the construction industry with job accounts

- Executing the release decision for new and old orders and transmitting the data to the ERP instantly

Another key highlight of this solution is the reprocessing logic for orders on hold, that can retry all open orders on hold to recompute the eligibility for a release. Order retry logic is required for the following reasons:

- Customer credit limit may increase since the last time the order was put on hold

- Customer may have made payments to reduce exposure

- Average days past due may have reduced

Results and Benefits

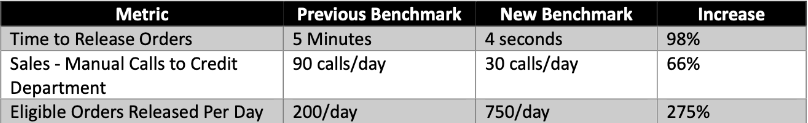

The solution detailed above was able to deal with large volumes of order data bringing huge efficiency gains for the credit department, as well as a significantly better front-end customer experience by releasing orders in real-time.

After the implementation of this module, the company was able to realize various hard and soft savings:

Hard Savings

Soft Savings

- Less wait time at branches leading to better customer experience

- Better sales and credit departments relationships

- Less churn & loss of business to customers

- FTE focus on larger strategic orders rather than smaller orders that can be automated

Future of Credit and AR

As AI continues to evolve and improve, credit, collections and AR will be at the forefront of implementation due to the sheer potential for optimization prevalent throughout all traditional processes. But those benefits won’t come without challenges, growing pains and the need for strict governance and testing at the beginning.

Challenges

A significant challenge in integrating AI into credit departments is ensuring quality and consistency. Optimal AI performance necessitates structured, clean and high-quality data.

However, many businesses face fragmentation across different systems or departments, resulting in inconsistencies that hinder AI performance. Additionally, handling sensitive financial information raises privacy and security concerns, necessitating robust cybersecurity measures.

Another significant challenge is the need for skills and expertise. The implementation of AI systems necessitates a good understanding of the technology, its potential and its limitations. Employees need to be trained not only to use these systems but also to interpret their outputs correctly. This can be a time-consuming and costly process. A key challenge here is that any AI processes you may put into place must be widely understood by the organization at large, otherwise, you will run the risk of mistrust in these new technologies.

Change Management: Governing and Controlling AI Post-Implementation

Once a company has implemented AI into their AR and credit processes, it's crucial to maintain a level of control to manage any changes effectively. This involves monitoring the system's performance, ensuring data privacy and security, and handling changes in the workforce dynamics.

Regularly tracking and analyzing the performance of the AI system is essential. This includes keeping an eye on the accuracy of predictions, the efficiency of automation and the overall impact on financial metrics. Regular audits can help identify any areas of concern early and address them promptly.

Data privacy and security are paramount. Implementing AI systems often involves handling large volumes of sensitive financial data. Ensuring that this data is stored and processed securely is crucial to maintaining customer trust and meeting regulatory requirements. This Includes regular security audits and staying updated on the latest cybersecurity threats and protection measures. Managing workforce dynamics is crucial after implementing AI. As AI automates routine tasks, it may alter the roles and responsibilities within a team. Clear communication, comprehensive training, and robust support are essential to facilitate a smooth transition for employees.

The Road Ahead: Analyzing the Obstacles Holding AI Back

While AI offers transformative potential for credit and AR departments, full adoption remains elusive due to a few factors. Key among them is the complexity and sensitivity of financial data, which demands high levels of accuracy and security. Many businesses grapple with fragmented data infrastructures, skills gaps and concerns about relinquishing too much control to automated systems. Moreover, there's the challenge of integrating AI with legacy systems, which may not always be compatible with newer technologies.

To achieve full AI adoption, businesses must prioritize a phased and holistic approach. This involves investing in staff training, refining data management practices and gradually integrating AI functions. Collaborating with AI experts and vendors can facilitate smoother transitions, while continuous monitoring and feedback loops ensure that AI systems remain efficient and effective. By addressing these challenges head-on, credit and AR departments can harness the full potential of AI.

Learn more about Order Hold Automation or request a personalized use case

Get started today