In the world of B2B transactions, credit risk analysis plays a vital role in keeping the wheels of commerce turning smoothly. But extending credit to another business can be a risky undertaking, especially if the other party is not financially stable or has a history of defaulting.

Having a robust B2B credit risk analysis process in place for your business is pivotal. By evaluating the creditworthiness of potential business partners, you can make informed decisions about extending credit, and actively minimize the risk of losses due to non-payment or bankruptcy.

Read on as we delve into B2B credit risk analysis, exploring the key concepts and best practices that you need to know to make sound credit decisions.

This blog was originally published on September 2, 2022. It has since been updated to reflect the latest statistics and best practices in the industry.

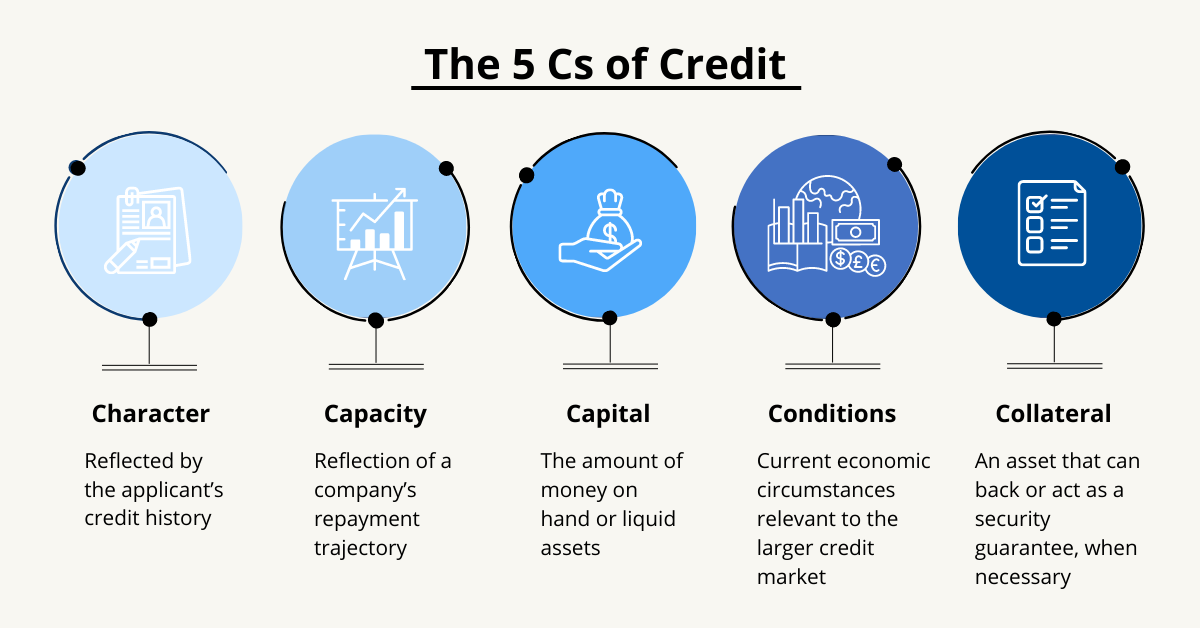

What Are The 5 Cs of Credit?

Lenders employ a basic framework known as the "5 Cs of credit," which consists of factors to comprehensively evaluate potential borrowers' creditworthiness: Character, capacity, capital, conditions and collateral. The five Cs can also help you tailor a risk model to your company to help make quality lending decisions.

- Character refers to the reputation of a company in the industry and its track record of paying bills on time. Lenders will look for consistency in payment behavior and may investigate the company’s credit history to evaluate its reliability in paying off debts.

- Capacity assesses the ability of a company to generate revenue and maintain positive cash flow. Lenders will evaluate a company’s financial statements to assess its profitability and liquidity.

- Capital is an assessment of a company’s overall financial health, including its assets and liabilities.

- Conditions mean the overall economic and market environment that could impact the company’s ability to repay a loan. Lenders consider factors such as industry trends, market status and economic stability when evaluating a B2B loan application.

- Collateral refers to assets that can serve as security for a loan. These could include inventory, equipment or accounts receivable. Lenders will evaluate the value of the collateral and its ability to be sold to recover funds in the case of default.

The 5 Cs framework is an excellent starting point to begin crafting your approach or risk model that will help to further assess your venture of extending credit to another business, minimizing the risk of loan defaulting while supporting your access to the capital you need to grow your business.

No two credit risk analysis processes are alike, and they vary greatly from industry to industry and are weighed differently across companies, in different economic conditions, according to societal events and more. Coming up with the perfect credit risk assessments for your business is at your discretion, with each risk model as unique as the company it represents.

Risk Models

Credit risk models and credit risk analysis help to predict the financial outcome of a given request by assessing the likelihood and scale of risk involved, and lenders rely on the validation provided by risk models to make quality lending decisions.

Credit risk assessments take into consideration distinct risk factors and assign a score to a customer based on quantitative and qualitative data. All of this information is compiled from and analyzed by considering each company’s distinct business model and setup, because each business’ history and foundation are as distinct as the product or service they offer.

Once you’ve created the ideal credit risk analysis for your business, Bectran can streamline the process by automating the intake and assessment to help you manage current and potential risk exposures. Our models cover the full spectrum of credit risk, seamlessly assigning a score based on the risk evaluation index you provide to every piece of information on a customer. We also offer model customization scorecards, capturing every detail of the customer’s borrowing and repayment trajectory.

A Better Approach to B2B Credit Risk Analysis

Mastering the art of credit risk analysis is vital for your business to make informed decisions and mitigate risk in the lending process. Effective credit risk analysis ensures that both you and your borrowers can achieve your financial goals and build long-lasting relationships built on trust and reliability. To dive deeper into how a robust credit risk analysis process can minimize risk for your business, learn more below.

The views expressed on this blog are those of the author and do not necessarily reflect the views of Bectran. This blog may contain links to content on third-party sites. By providing such links, Bectran does not adopt, guarantee, approve or endorse the information, views or products available on such sites.

Social Media Links: Twitter | LinkedIn

Bectran is a registered trademark of Bectran, Inc.

Media Contact

marketing@bectran.com

Solutions Contact

Nolan Grandaw

nolan.grandaw@bectran.com

(630) 626-4914

-1.png)

.png)

-1.png)