One size does not fit all, especially in credit risk management. Better understanding of the credit risk profile of your customers leads to better credit decisions, likewise poor understanding leads to poor credit decisions.

Traditional Scoring Systems

Traditional credit risk assessment and credit risk management methods rely heavily on manual methods of data capture, aggregation and analysis. At best, few companies have quasi-digital internal risk assessment methods that rely on arcane and non-rigorous Scorecard Systems. Such scorecard systems lack the scale and flexibility to address differences in the credit risk characteristics across a broad customer base.

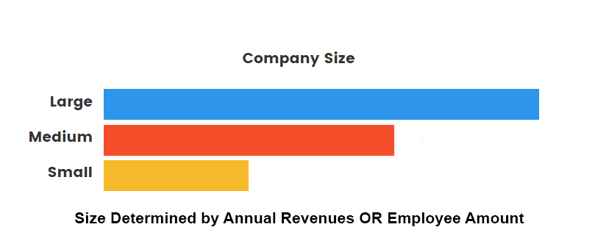

Truth is that customers, be they small-, medium- or large-scale companies, exhibit major differences in their risk characteristics depending on their size, industry, nature of business, management quality, organizational complexity, etc. It therefore follows that assessing customers for credit risk using a single, no-variable and non-segmented credit risk evaluation model inevitably leads to misunderstandings of the customer risk profile and ultimately suboptimal credit decisions. Unfortunately, most companies lack the computational framework and capability that allows them to segment their customers by credit risk characteristics and apply the appropriate credit risk management evaluation techniques.

What is Segmented Scoring and Why is Segmented Scoring Necessary?

Segmented Scoring is a dynamic credit risk framework that allows companies to segment their entire customer base by characteristics of their customers’ credit risk profile. It allows companies to segment their entire customer base by the characteristics of the customers’ credit risk profile.

Risk segmentation helps companies gain better insight into their customer’s credit worthiness while at the same time speeding up their credit management process.

How can Bectran Help?

One size does not fit all, especially, in credit risk management. Bectran has developed a time-tested and industry-proven dynamic credit risk assessment framework that allows companies to segment their entire customer base by the characteristics of the customers’ credit risk profile. With risk segmentation and granular risk modelling within risk segments, the Bectran Advanced Scoring System helps companies gain better insight into the Credit Portfolios of their customers while at the same time speeding up the time to manage their credit origination process.

-1.png)

.png)

-1.png)