As the technology space continually evolves, B2B organizations must acknowledge the need to adapt to the demands of the industry – and taking advantage of the timesaving and error-prevention benefits provided by SaaS is one of the best ways B2B companies are staying competitive. Many companies have adopted SaaS-based infrastructure to reduce mundane tasks, automate manual processes and decrease processing errors.

Implementing a SaaS software product into your accounts receivable workflow gives you structure to systematize accounting procedures — regardless of scale or size. It also drives productivity, accelerates the order-to-cash cycle and frees up your time to deliver better customer experiences. Here’s everything you need to know to start leveraging SaaS into your accounts receivable procedures.

Defining Accounts Receivable Technology

Accounts receivable (AR) software is a centralized application that manages end-to-end reporting and monitoring of accounts receivable processes. This type of technology automates invoicing, tracks collections and aging and matches sales orders and invoices with payments. Typically, this software encompasses the entirety of the accounts receivable lifecycle, from portfolio analytics to cash application. The capacity to handle high volumes of invoices and payments is a key feature of AR software, significantly decreasing the manual effort expended by your team when collecting payments.

In short, this technology can replace outdated and error-prone methods of processing and monitoring incoming payments and securing revenue. Large businesses that continue to use traditional AR practices may find it difficult to manage invoices and receivables, especially during unstable economic conditions. But the task automation offered by a SaaS product can eliminate that difficulty and propel your business to perform more efficiently and significantly improve DSO (day sales outstanding). Similarly, data aggregation within the software provides a common repository where all users can access information. This transparency is key to maintaining a close eye on risky accounts to minimize bad debts, and a cloud-based SaaS infrastructure can help you achieve this.

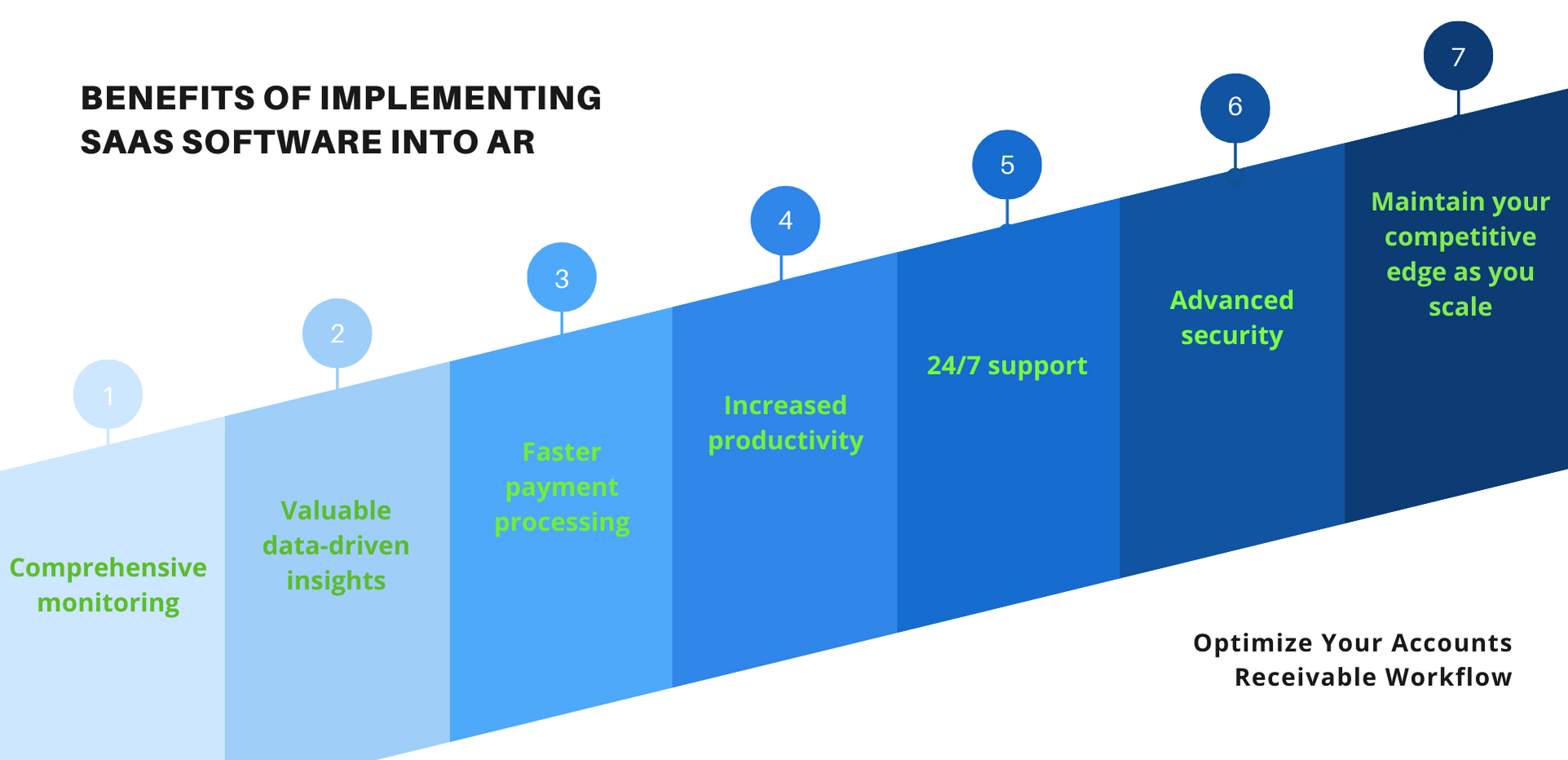

What are the Benefits of Implementing SaaS Software into AR?

Gone are the days of repeatedly calling a customer, faxing or mailing invoices and manually assigning payments to outstanding accounts. Here’s how cloud-based software can streamline and enhance your accounts receivable operations.

- Comprehensive monitoring: robust reporting capabilities allow you to continuously pull reports on customers and monitor credit risk in real time

- Valuable data-driven insights: by easily organizing customers into portfolios, you can rest easy knowing your accounts are being nurtured and monitored in real-time

- Faster payment processing: automation significantly reduces day sales outstanding (DSO) as opposed to manual AR processing

- Increased productivity: automating tedious and time-consuming tasks allows you to focus on adding more value to your strategic initiatives

- 24/7 support: customers continuously receive updates regarding new features and additions to the platform

- Advanced security: use the product with confidence knowing that your data is secure

- Maintain your competitive edge as you scale: as your company scales and accounts become more complex, SaaS allows you to maintain your core competency no matter how large your company grows or how rapidly the growth occurs

What Can SaaS Do for your Business?

Utilizing cloud-based or SaaS technology for AR processes can make life easier for your financial executives by offering increased processing accuracy and a better method for managing the order-to-cash cycle and customer relations. Below are just a few of the proficiencies you can look forward to in adopting cloud-based technology.

- Automate full risk assessments: create a comprehensive scorecard based on criteria you choose, your relationship with customers and a full-panel analysis of transaction history.

- Organize and assign portfolios: segment access, configure unique strategies for collections and quickly glance at the performance of an entire bucket of customers in one portfolio

- Automate recurring tasks: build and customize your own scoring models and evaluate your customers for creditworthiness, credit limit and rating in real-time

- Utilize comprehensive auditing capabilities: end-to-end monitoring gives your customers total visibility into their account status, helps them see outstanding invoices, summarizes payment history and more

These capabilities not only help mitigate risk in real time and decrease your workload, but they also help eliminate processing errors due to the digitization and standardization of recurring tasks. Most importantly, you can gain back your time and freedom to focus on other organizational initiatives.

A Better Approach to AR with SaaS: How Bectran Can Help

If you are ready to let SaaS transform your business and make paper a thing of the past, check out the Bectran accounts receivable solution to see firsthand how it can optimize your accounts receivable process. Our solution covers all aspects of accounts receivable management from disputes, claims and settlements to order hold management. Automation streamlines processes for you, and end-to-end monitoring helps you proactively mitigate exposure in real time.

The views expressed on this blog are those of the author and do not necessarily reflect the views of Bectran. This blog may contain links to content on third-party sites. By providing such links, Bectran does not adopt, guarantee, approve or endorse the information, views or products available on such sites.

-

Social Media Links: Twitter | LinkedIn

Bectran is a registered trademark of Bectran, Inc.

-

Media Contact

marketing@bectran.com

-1.png)

.png)

-1.png)