Managing high volumes of credit requests (includes credit application process requests and requests for credit limit increases by existing customers) can be expensive for a company in terms of customer service quality and credit risk. Traditionally, with higher volumes of credit application process requests, companies tend to either hire more staff or lower the threshold for credit risk evaluation in order to cope with the volume. But even with increased staff, the processing capacity will still be limited by the efficiency of the underlying manual process. Thus generally, service quality and credit risk tend to degrade as the volume of credit requests increases. However, with an intelligent automation solution, a company can process high volumes of credit application process requests without compromising credit risk and service quality at no additional staff overhead.

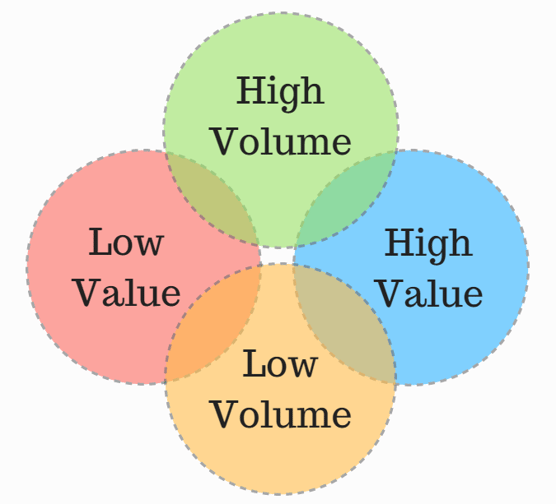

It’s also important to segment the credit requests into LOW and HIGH values. Low value credit requests typically range from $1000 to $20,000 depending on the customer demographic. Processing low value credit requests manually when volume is high, say 200 plus credit requests per month, can be very time consuming and creates opportunities for sub-optimal credit assessments and errors that could portend a cumulative trend of significant credit risk. The typical profile of companies with High Volume, Low Value credit requests are companies that sell to lots of mom and pop or small and medium scale companies. With little public and bureau credit information on these class of customers, the expectation is that a more methodical data collection and risk assessment should be done to determine the credit worthiness of each customer.

| Low Value | *** | |

| High Value | ||

| Low Volume | High Volume |

Given the need for thorough and methodical risk assessment in the High Volume, Low Value quadrant, a well-crafted and customizable automation solution would help significantly to lower the operating costs of processing and free up credit personnel capacity to concentrate on the Low Volume, High Value quadrant in addition to other more strategic credit risk management activities.

The Bectran Instant Decision Management (IDM) solution addresses high volume credit requests with improved credit risk management and high service quality delivery. With the Bectran IDM, companies are able to segment their customer base by risk and apply appropriate credit assessment and data requirement rules for automatic credit approvals. Thus, with IDM, customers are approved for credit within seconds of completing and submitting their credit application when the customer credit data passes the risk assessment threshold test.

-1.png)

.png)

-1.png)